A common question among people trying to improve their credit is when to expect their score to change. While your score may not change significantly for a few weeks, it is constantly updated. There are several factors that determine when your score will change, and these can vary depending on your situation and financial goals.

Your credit score will be calculated based upon your credit reports. Your credit score is affected by how timely you make payments. Late payments, increased balances, or opening new accounts can all impact your credit score. Your credit score can be improved by paying off your loans and paying down your credit card debts. It is possible to not notice any improvement in your credit score for as long as you only make one or a few payments each month.

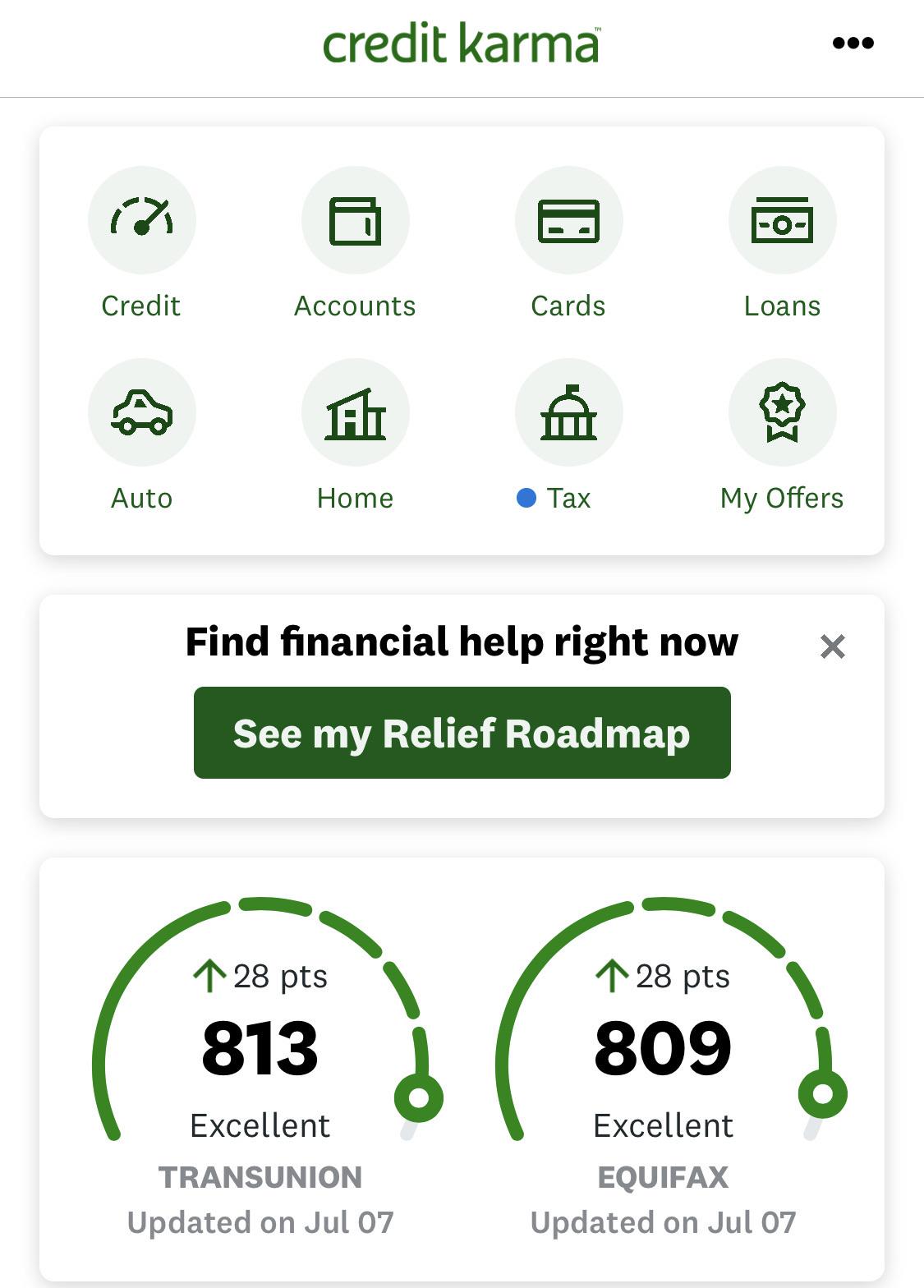

TransUnion, Equifax and Experian are the three major credit bureaus. Each credit bureau will give you a free copy. The agencies can update your score as soon as they receive additional information from creditors. They may also update your score daily, weekly or monthly, depending on the time you checked your report.

Your credit score is not the only information in your report. Other financial information, such as credit requests and credit limits, may also be included. This information can help lenders determine whether you qualify for a loan, and the interest rate you'll be offered. You will most likely see an update to your score each month if you have only one credit account. Your score will fluctuate more often if there are multiple credit products. If you apply for an automobile loan, your score may be affected.

Creditors report information to the credit bureaus approximately once per month. But that doesn’t mean they will update every day. In reality, it all depends on your personal situation as well as the number of lenders that you deal with.

Some creditors only allow you to send information to one or two of the CRAs. Others may not report at any time. Each lender's reporting schedule is different, and you will need to check your credit reports regularly to see if there have been any updates.

Credit Karma can help you determine when your score is likely to change. You can get free credit scores and reports when you subscribe to their service. You can request a new credit score. They will explain the reasons behind your score change.

Register for VantageScore 3.0, to get a free copy your credit report every week. This score uses information from Equifax, as well Experian. Similar services can be offered by other companies. Although there are many types and levels of credit, FICO is still the best system for scoring consumer credit.

Your credit score can be affected by many things, so it is best to be patient while you try to improve your score. It can make a big difference in your ability to purchase a home, car, or apartment.

FAQ

How can I get started investing and growing my wealth?

Learn how to make smart investments. By learning how to invest wisely, you will avoid losing all of your hard-earned money.

Learn how to grow your food. It's not difficult as you may think. You can grow enough vegetables for your family and yourself with the right tools.

You don't need much space either. You just need to have enough sunlight. Consider planting flowers around your home. They are easy to maintain and add beauty to any house.

If you are looking to save money, then consider purchasing used products instead of buying new ones. They are often cheaper and last longer than new goods.

Is it possible to earn passive income without starting a business?

It is. Most people who have achieved success today were entrepreneurs. Many of them were entrepreneurs before they became celebrities.

You don't necessarily need a business to generate passive income. Instead, you can just create products and/or services that others will use.

You might write articles about subjects that interest you. You can also write books. You could even offer consulting services. The only requirement is that you must provide value to others.

What types of investments are there?

Today, there are many kinds of investments.

Some of the most loved are:

-

Stocks - Shares of a company that trades publicly on a stock exchange.

-

Bonds – A loan between parties that is secured against future earnings.

-

Real Estate - Property not owned by the owner.

-

Options – Contracts allow the buyer to choose between buying shares at a fixed rate and purchasing them within a time frame.

-

Commodities-Resources such as oil and gold or silver.

-

Precious metals – Gold, silver, palladium, and platinum.

-

Foreign currencies – Currencies not included in the U.S. dollar

-

Cash – Money that is put in banks.

-

Treasury bills - A short-term debt issued and endorsed by the government.

-

Commercial paper is a form of debt that businesses issue.

-

Mortgages – Loans provided by financial institutions to individuals.

-

Mutual Funds - Investment vehicles that pool money from investors and then distribute the money among various securities.

-

ETFs (Exchange-traded Funds) - ETFs can be described as mutual funds but do not require sales commissions.

-

Index funds - An investment vehicle that tracks the performance in a specific market sector or group.

-

Leverage - The ability to borrow money to amplify returns.

-

Exchange Traded Funds (ETFs - Exchange-traded fund are a type mutual fund that trades just like any other security on an exchange.

These funds are great because they provide diversification benefits.

Diversification is when you invest in multiple types of assets instead of one type of asset.

This protects you against the loss of one investment.

What are the 4 types?

There are four main types: equity, debt, real property, and cash.

A debt is an obligation to repay the money at a later time. This is often used to finance large projects like factories and houses. Equity is the right to buy shares in a company. Real estate is land or buildings you own. Cash is what you have on hand right now.

When you invest in stocks, bonds, mutual funds, or other securities, you become part owner of the business. You share in the profits and losses.

Which fund is best for beginners?

When it comes to investing, the most important thing you can do is make sure you do what you love. If you have been trading forex, then start off by using an online broker such as FXCM. If you want to learn to trade well, then they will provide free training and support.

If you are not confident enough to use an electronic broker, then you should look for a local branch where you can meet trader face to face. You can ask them questions and they will help you better understand trading.

The next step would be to choose a platform to trade on. CFD platforms and Forex can be difficult for traders to choose between. Both types trading involve speculation. Forex does have some advantages over CFDs. Forex involves actual currency trading, while CFDs simply track price movements for stocks.

It is therefore easier to predict future trends with Forex than with CFDs.

But remember that Forex is highly volatile and can be risky. CFDs are preferred by traders for this reason.

Summarising, we recommend you start with Forex. Once you are comfortable with it, then move on to CFDs.

Should I make an investment in real estate

Real Estate Investments can help you generate passive income. They require large amounts of capital upfront.

Real Estate might not be the best option if you're looking for quick returns.

Instead, consider putting your money into dividend-paying stocks. These pay monthly dividends, which can be reinvested to further increase your earnings.

Statistics

- According to the Federal Reserve of St. Louis, only about half of millennials (those born from 1981-1996) are invested in the stock market. (schwab.com)

- Most banks offer CDs at a return of less than 2% per year, which is not even enough to keep up with inflation. (ruleoneinvesting.com)

- Some traders typically risk 2-5% of their capital based on any particular trade. (investopedia.com)

- As a general rule of thumb, you want to aim to invest a total of 10% to 15% of your income each year for retirement — your employer match counts toward that goal. (nerdwallet.com)

External Links

How To

How to invest In Commodities

Investing in commodities involves buying physical assets like oil fields, mines, plantations, etc., and then selling them later at higher prices. This process is called commodity trade.

Commodity investment is based on the idea that when there's more demand, the price for a particular asset will rise. The price will usually fall if there is less demand.

You don't want to sell something if the price is going up. You would rather sell it if the market is declining.

There are three major types of commodity investors: hedgers, speculators and arbitrageurs.

A speculator would buy a commodity because he expects that its price will rise. He doesn't care whether the price falls. Someone who has gold bullion would be an example. Or someone who is an investor in oil futures.

An investor who invests in a commodity to lower its price is known as a "hedger". Hedging allows you to hedge against any unexpected price changes. If you have shares in a company that produces widgets and the price drops, you may want to hedge your position with shorting (selling) certain shares. This is where you borrow shares from someone else and then replace them with yours. The hope is that the price will fall enough to compensate. When the stock is already falling, shorting shares works well.

A third type is the "arbitrager". Arbitragers trade one thing to get another thing they prefer. For instance, if you're interested in buying coffee beans, you could buy coffee beans directly from farmers, or you could buy coffee futures. Futures let you sell coffee beans at a fixed price later. You are not obliged to use the coffee bean, but you have the right to choose whether to keep or sell them.

The idea behind all this is that you can buy things now without paying more than you would later. If you know that you'll need to buy something in future, it's better not to wait.

Any type of investing comes with risks. One risk is that commodities could drop unexpectedly. Another risk is the possibility that your investment's price could decline in the future. This can be mitigated by diversifying the portfolio to include different types and types of investments.

Taxes are also important. You must calculate how much tax you will owe on your profits if you intend to sell your investments.

If you're going to hold your investments longer than a year, you should also consider capital gains taxes. Capital gains tax applies only to any profits that you make after holding an investment for longer than 12 months.

You may get ordinary income if you don't plan to hold on to your investments for the long-term. Ordinary income taxes apply to earnings you earn each year.

Investing in commodities can lead to a loss of money within the first few years. However, you can still make money when your portfolio grows.